More Pending Homes Are Falling Through, but No Need to Sound the Alarms

- The share of contract cancellations — pending listings that have gone back on the market without a sale — has recently increased, but remains in line with pre-pandemic norms.

- The recent increase in contract cancellations is more evidence of a rebalancing in the housing market that has both eased buyer demand and given buyers who remain in the market more negotiating power than they have had for most of the pandemic.

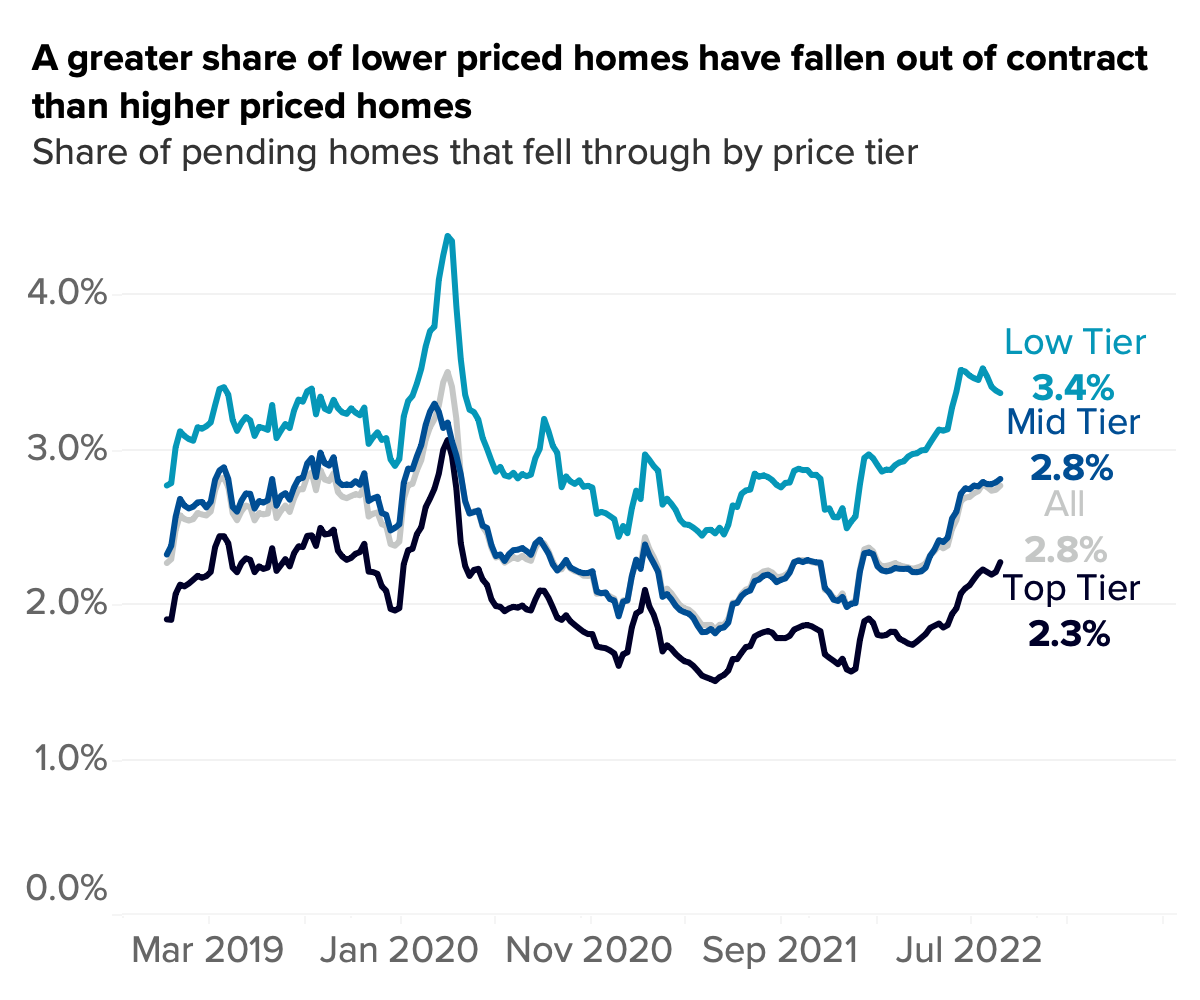

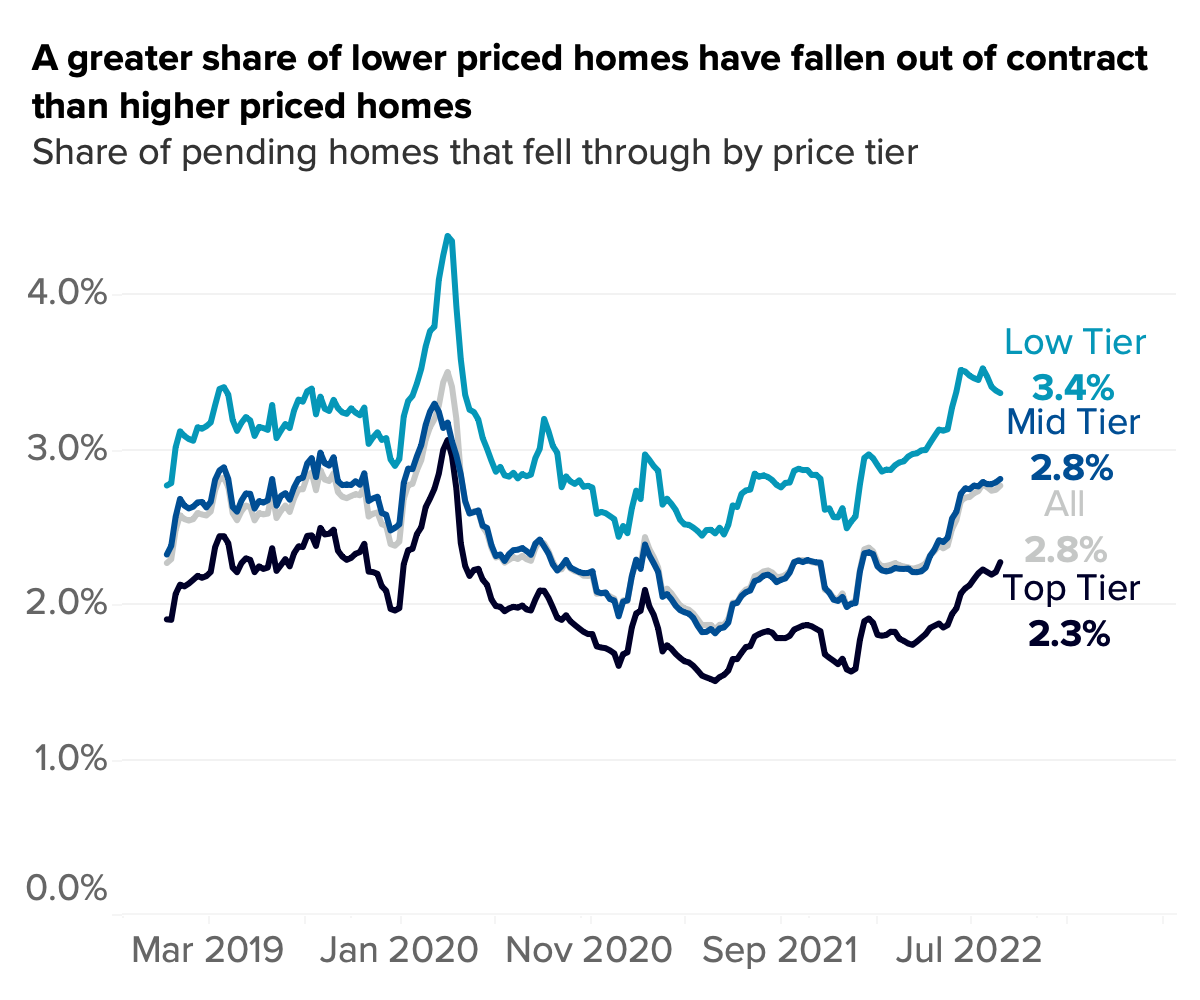

- A greater share of lower priced homes have fallen out of contract than higher priced homes. This likely reflects affordability challenges taking their toll on buyers with relatively lower incomes as mortgage rates have risen.

A quickly rebalancing housing market – brought about by sharp increases in mortgage rates that have pushed monthly payments beyond what many can afford – has caused homebuyers and sellers to reset their expectations. One outcome of these rapidly changing conditions and shifting expectations is a recent increase in the share of pending home sales that fall through.

As of the end of August, the share of pending home sales that fell through, then ended up back on market – measured weekly – had increased by 0.8 percentage points (2.0% to 2.8%) from the beginning of the year. Put differently, about one of every 36 pending sales fell through in the last week in August, compared to about one in every 50 at the beginning of the year, and one out of every 45 at the end of last August.

There are a number of reasons why a pending home sale would fall through. Quickly rising mortgage rates were likely causing some buyers to move from being able to afford a mortgage on the home they bid on, to not being able to afford that mortgage as the cost exceeds their allowable limit for a debt to income ratio. Affordability is likely a major reason why contracts fail, especially as more lower priced pending homes end up back on market than other price tiers.

Another cause of contract cancellations could be from buyers taking back control of negotiating power. Competition for homes has eased as many buyers have taken a step back from the market. Inspections and other contingencies are no longer being waived to the same degree as earlier in the pandemic. A failed inspection or any questionable findings might be leading to more contracts falling through now while desperate buyers may have been more willing to go through with a risky purchase when competition was at a fever pitch earlier in the pandemic.

Regardless of why a deal failed to close, the recent increase in this dynamic is yet more evidence of how the housing market has quickly shifted in recent months. And more evidence that perhaps well-off buyers are really able to be more choosy in this market now that competition is less of a concern, and are less keen to jump on a home simply because it’s available.

The 80-basis-point increase in the share of pending sales that fall through is a significant shift, but the share of pending sales that don’t result in a sale remains within pre-pandemic norms. In the years preceding the COVID-19 pandemic, the weekly rate at which pending sales fell through was generally around 2.5%, in line with what the market is seeing now. What’s more, the share of pending fall throughs has recently shown signs of stabilizing. This may be due to buyers exiting the market altogether as affordability challenges persist, or reflect that pricing and sales expectations have adjusted to meet the changing market conditions.

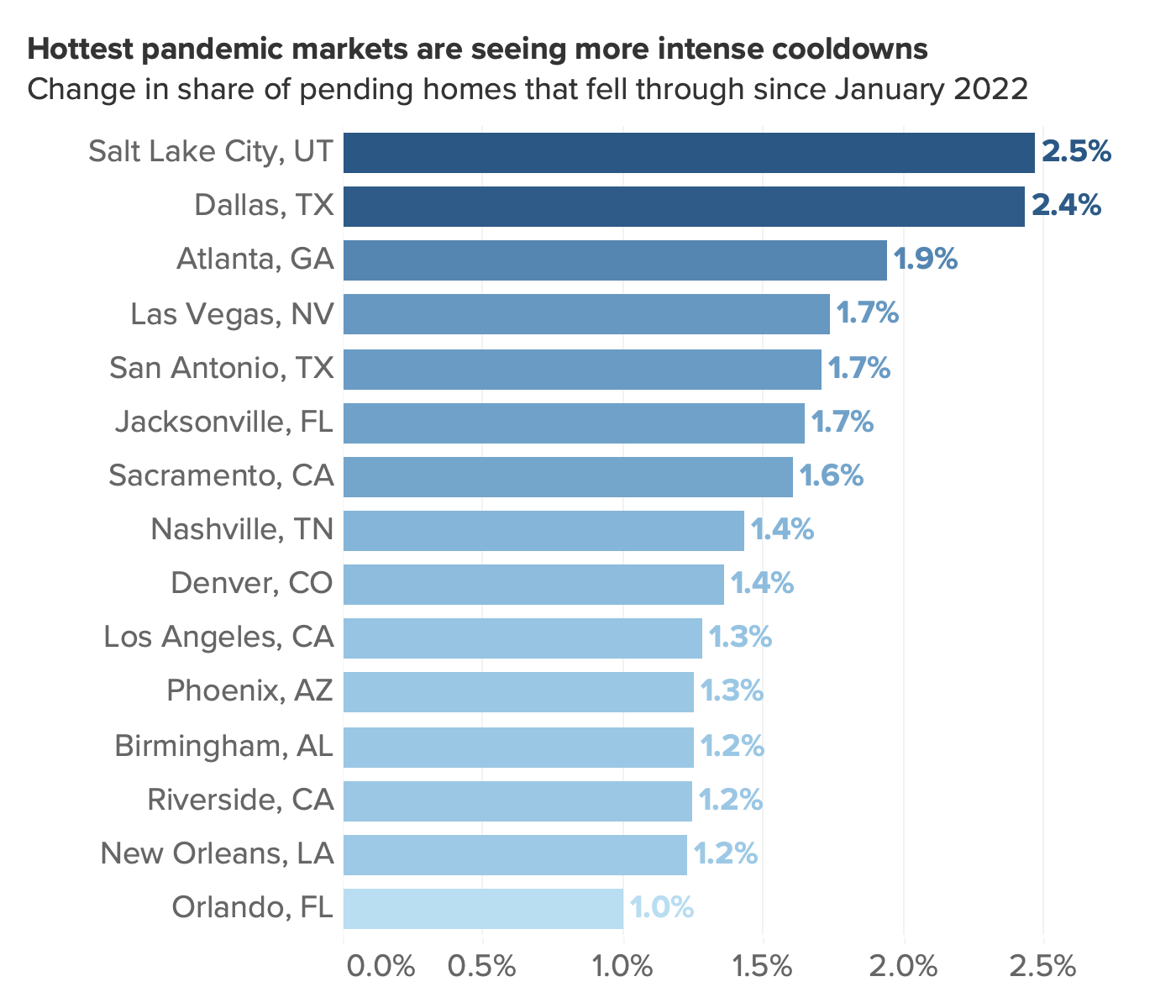

Throughout the Sun Belt, which hosts the majority of the hottest markets of the pandemic where prices rose the fastest, the cooldown will feel more intense as there is more room to fall back to normal from the high peaks of home value appreciation. Salt Lake City and Dallas, both relatively competitive markets during the past few years, saw the share of pending homes that fell through increase by more than two percentage points since the beginning of 2022, more than doubling the share of cancellations in these markets as interest rates rose and the market began to shift. Sellers are needing to reset their expectations as buyers are either stepping back from the market because of affordability constraints, or holding more negotiating power and requiring more realistic prices and terms if they’re still able to afford to buy.

Categories

Recent Posts