Southern California home prices have been falling. Are the drops over?

Last year, rising mortgage interest rates chilled the previously hot Southern California housing market. Buyers backed off, sales plunged and, for the first time in a decade, home prices underwent a sustained slide. By one measure, prices in the six-county region fell 13% from the peak last spring.

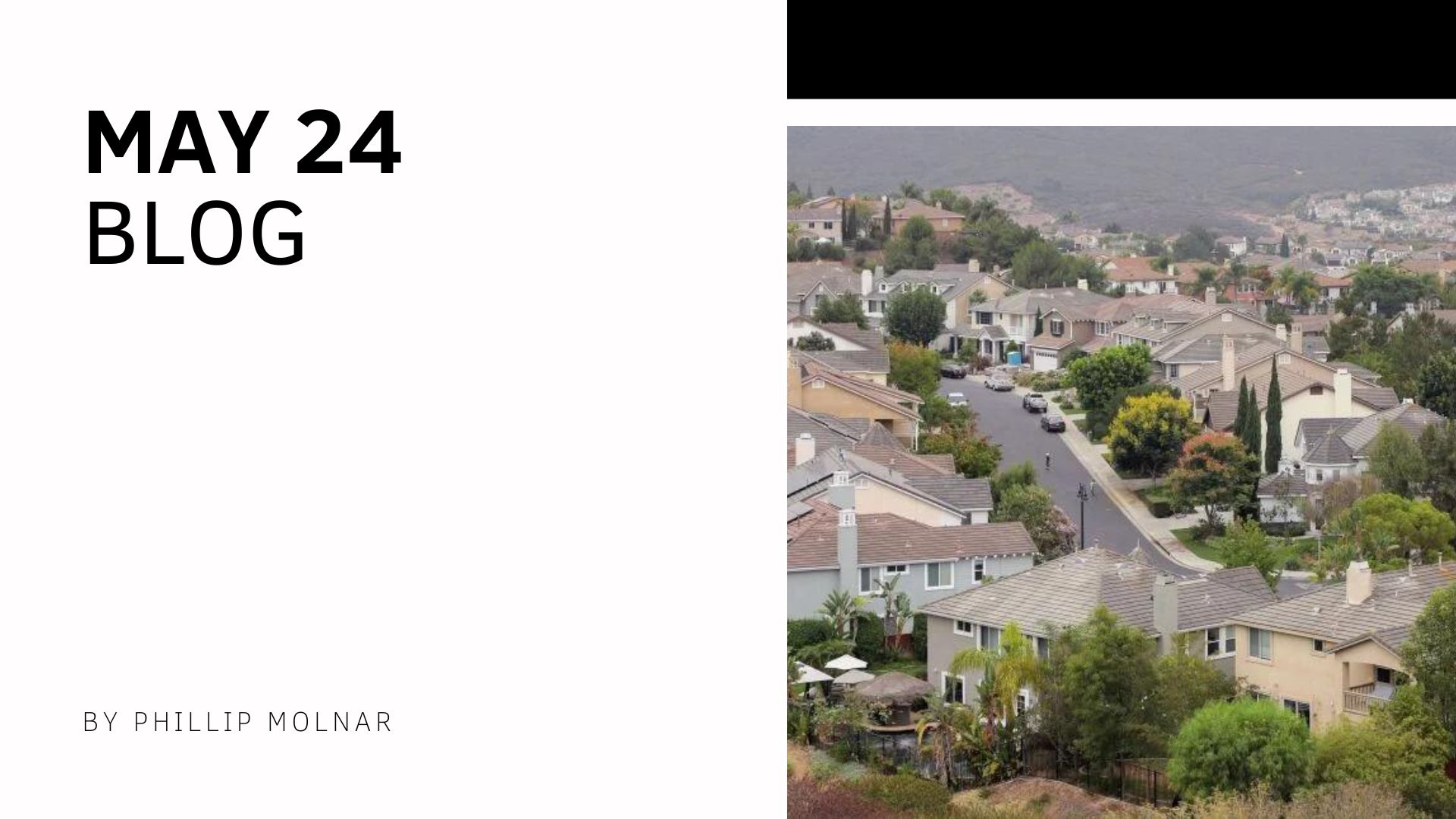

'People waiting for prices to come down will be disappointed': San Diego home price rises for 2nd month

San Diego County home prices are rising again after months of declines. Pictured: Homes in the San Elijo area north of the intersection of San Elijo Road and Elfin Forest Road in south San Marcos. (The San Diego Union-Tribune) San Diego County home prices are rising again after months of declines.

Higher density, more SROs and a controversial new state law: What’s in San Diego’s sweeping new housing proposal

San Diego Mayor Todd Gloria is proposing a sweeping package of incentives and regulatory changes that aim to boost construction of housing for middle-income residents, college students and people facing homelessness. One proposal would make San Diego one of the few cities in California to embrace c

Categories

Recent Posts