Market Update

Words from our Lender, Ronnie King with Elite Lending Team Happy Monday!Finally, some good news as we start the week. After the inflation report came back last Thursday much better than anticipated, we saw a HUGE rally for mortgage bonds. We gained 206 basis points in that one rally helping rates improve by nearly .75%!! Of course, it is a bit natural to see these bonds pullback a bit today. We are starting the week off floating all loans. If we continue to see inflation decrease, the Feds will eventually start to pump the brakes on their hikes. With that said, they will need to see a continued decline before they even think about acting!We all know that the labor market is a major lagging indicator. However, look at the summary of some of the layoffs announced this year. These numbers will eventually hit the unemployment statistics. Twitter cutting 50% of its workforce (3,700 jobs). Facebook cutting 13% (11,000 jobs), Snap cutting 20% (1,200 jobs), Shopify 10% (1,000 jobs), Netflix (450 jobs). 2nd round of layoffs, Microsoft 1% (1,000 jobs) Salesforce (1,000 jobs), Robinhood 31%, Tesla 10%, Lyft 14%, Redfin 13%, Coinbase 18%. With that said, here are a few companies adding some additions to cuts: Amazon has announced a hiring freeze, Apple has paused almost all hiring and google is reducing hiring bay 50%.We have a busy week ahead with news! The Producer price index will report tomorrow. Wednesday we have mortgage application, retail sales, NAHB housing market index and the 20-year auction. Thursday, we have housing starts and stops & initial jobless claims. We end the week Friday with the existing home sales! As of this morning: Conventional loans under 647K are at 5.99% - 6.125% High Balance loans up to 879K 6.75% - 6.99% VA & FHA loans range 5.75% -6.125% As always, I am here to answer any questions you have! Please do not hesitate to reach out. Ronnie King -Brand Manager ronnie@elitelendingtm.com (858)519-7091

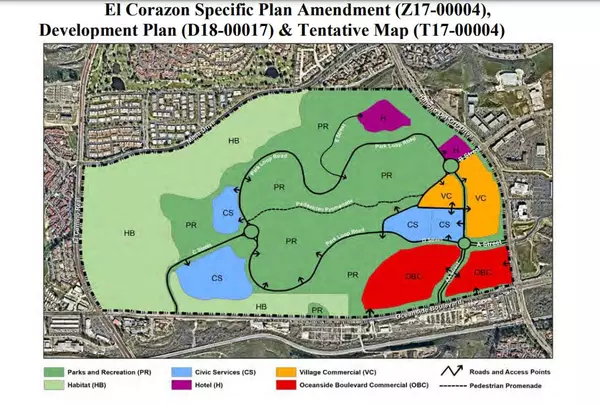

Oceanside approves sale of more El Corazon parkland

OCEANSIDE — The city approved the sale of vacant commercial land at El Corazon Park to the new Frontwave Arena developer — free of charge. The Oceanside City Council on Nov. 2 approved a purchase and sale agreement to Sudberry Development for 51.1 acres of vacant commercial land along Oceanside Boulevard for a mixed-use, industrial and retail project anchored by a pharmaceutical facility. Sudberry submitted a request to purchase the commercial acreage from the city in August. In May 2021, the developer purchased the land where Frontwave Arena is currently under construction and a portion of El Corazon’s Village Commercial for a 268-unit, mixed-use apartment complex with for-lease commercial space. These land dispositions were free of charge, as outlined in a pair of Commercial Disposition and Development Agreements (DDA) between Sudberry and the city, approved in 2013. The developer will be responsible for development costs, which are estimated at $186 million. The agreements allow Sudberry to develop the Village Commercial, Oceanside Boulevard and Hotel areas as designated by the El Corazon Specific Plan, which governs the overall development of El Corazon’s 465 acres. According to the Commercial DDA, Sudberry can purchase land if it finds that a ground lease would be “economically disadvantageous.” Commercial real estate consulting firm JLL determined ground leases were unfavorable to Sudberry for the previously purchased arena and Village Commercial space. The Commercial DDA uses a land valuation formula to determine the purchase price. If the return on cost is less than 10.5%, no rent or value is required of the developer. In this case, the return on expenditure was 7.5%, meaning Sudberry could once again purchase a chunk of commercial land to be developed at El Corazon for free. The city will also have to spend up to $15,000 in closing costs for the purchase. Despite the majority of the City Council’s lack of enthusiasm over giving away more land to Sudberry, Mayor Esther Sanchez was the only council member to vote against it. “This was a really bad agreement,” Sanchez said. Deputy Mayor Ryan Keim said denying the request could make the city legally liable by acting against its agreement with Sudberry, noting that Sanchez was one of the council members who approved the deal with Sudberry in 2013. “That’s the deal you made, Mayor, and whether or not I like it, I have to support this motion,” Keim said. Councilman Christopher Rodriguez called the agreement with Sudberry a “failure” and also blamed Sanchez for her part in approving the agreement years ago. Sanchez defended the council’s decision, saying members relied on the work of city staff when making their decision. “I voted for the funding (of the park),” Sanchez said. “It was brought to me by our experts, who were wrong.” Despite not receiving any money for the purchase of the commercial land, the city can expect an estimated annual economic benefit of about $710,000 with the commercial project, which also anticipates creating 784 new jobs in the city. Approximately $395,000 of that estimated amount will be annual tax revenue for the city. The project will construct a build-to-suit, 251,600-square-foot facility for Ionis Pharmaceuticals, plus two additional buildings for limited warehouse usage and a set of retail buildings whose tenants have yet to be determined. Plans suggest possible drive-thru restaurants and a gas station with a car wash. Once Ionis begins operations, the company will generate about 200 new jobs, most of which hold six-figure incomes. Joan Bockman, president of the Friends of El Corazon, said the group supports the pharmaceutical facility and feels confident that Sudberry will develop landscaping for the project as expected. However, Bockman said the group has issues with the project, including fast food drive-thrus bringing more idling cars that could hurt the city’s environmental goals. Councilman Peter Weiss said the council was only deciding on the disposition of the commercial land, and the makeup of the retail stores could be decided at another time. Bockman also said the focus of the project is wrong. “The city should be working on building a park rather than just the commercial area,” Bockman said. “Nothing has been built on the green part of our park on the map.” The city just entered the design phase for El Corazon’s first park site earlier this year. At the request of Keim, City Manager Jonathan Borrego agreed to bring back options that could further the park’s development financially within three months.

Redfin shares hit record low after analyst recommends selling

Company called “fundamentally flawed” ahead of Q3 earnings A photo illustration of Redfin CEO Glenn Kelman (Getty, Redfin) Redfin’s tough year grew even tougher on Monday when an analyst downgraded its stock, citing doubts about its business model and sending its share price to a record low. Days before of the discount brokerage’s third-quarter earnings release, Oppenheimer analyst Jason Helfstein cut his recommendation from a hold-equivalent rating to an underperform, Bloomberg reported. Helfstein also lowered his price target all the way down to $1.30, essentially advising investors to sell before things get worse. “We believe that Redfin’s business is fundamentally flawed, as the company continues to use a fixed-cost model for agents,” Helfstein wrote. “This prevents the company from optimizing margins when the housing markets decline and limits share gains when markets rebound.” Redfin’s stock hit an all-time low of $3.32 by midday before rebounding slightly to $3.63 when the markets closed. Its shares have lost more than 90 percent of their value since the start of the year. The company is due to report its third-quarter earnings on Wednesday. In the second quarter, Redfin reported a net loss of $78.1 million, compared to a net loss of $27.9 million in last year’s second quarter. At the time, chief executive officer Glenn Kelman said the losses wouldn’t be “enough to sink our battleship” and expressed a belief that its properties division would earn a “significant gross profit for the full year.” As recently as last year, Redfin was soaring. In February 2021, as its share price topped $95, the brokerage was looking to expand its agent count, hiring “faster than ever.” But this year, as rising mortgage rates wreaked havoc on the housing market, things took a sharp turn. In June, Redfin announced it would be laying off around 470 employees, or approximately 8 percent of its workforce. Kelman referred to the layoffs as a “setback,” but said there would be no changes to how it compensates its agents, who earn salaries and bonuses based on closings, rather than a traditional commission structure

Categories

Recent Posts