The Housing Market Slowdown, Explained in 7 Charts

After mortgage rates hit record lows during the pandemic, driving up demand for new homes and pushing up listing prices, the housing market is now slowing down. That’s good news for buyers who can afford to stay in the market. But many prospective buyers are being priced out as high mortgage rates and steep prices make it unaffordable for some to purchase a new home. At the same time, new home construction has decreased as builders become warier of falling demand — and rent prices have continued to increase. What questions do you have about the US economy? Vox economic policy reporter Madeleine Ngo is here to help you unpack what’s happening with the economy and how it affects your life. Submit your question here. “Buyers have negotiating power really for the first time in several years,” said Nicole Bachaud, a senior economist at Zillow. “But that’s with the caveat of, only if you can afford home prices right now.” Here are seven charts that help explain what’s happening with the housing market. The average 30-year fixed mortgage rate reached 5.66 percent as of Sept. 1, according to Freddie Mac data. The rate has fluctuated in recent weeks, although it has slightly come down from its peak of 5.81 percent in June, which was the highest level since 2008. Mortgage rates cratered during the pandemic over fears about the coronavirus and its impact on the US economy (in January 2021, the 30-year fixed mortgage rate reached 2.65 percent). That led to increased demand for homes, since lower mortgage rates make the cost of purchasing a house much cheaper because people have to pay less interest each month. Mortgage rates rose rapidly earlier this year, in part because the Federal Reserve began raising interest rates to deal with high inflation. Although the Fed doesn’t directly set mortgage rates, higher interest rates generally make borrowing money more expensive across the economy. Fed policy is also one of the factors that can influence the 10-year Treasury yield, which fixed mortgage rates tend to track. As mortgage rates have risen, more buyers have been priced out of the housing market, cooling demand and increasing the supply of available homes. Sales of new single-family and existing homes have plummeted, signaling cooler demand as high mortgage rates and home prices push potential buyers out of the market. Sales of new single-family houses in July were at a seasonally adjusted annual rate of 511,000 units, which is down 12.6 percent from June, according to Census Bureau data. That marks a nearly seven-year low. The amount of time that listings are sitting on the market has also increased as competition has cooled down. The share of US homes that were listed for 30 days or longer without going under contract increased 12.5 percent in July compared to a year earlier, according to Redfin data. Prices of homes skyrocketed as more Americans tried to take advantage of lower mortgage rates earlier in the pandemic. The combination of lower mortgage rates and an already short supply of houses led to bidding wars among potential buyers who were making offers above the listing price to beat out their competitors. Although prices are starting to come down now, they still remain much higher than they were a year ago. The median existing-home price was $403,800 in July, according to data from the National Association of Realtors. That’s down $10,000 from June, but still 10.8 percent higher than a year before. Some regions have seen home prices drop more rapidly, particularly in towns that have seen stronger demand for homes during the pandemic. For example, 70 percent of homes for sale in Boise, Idaho, dropped in price in July, according to a Redfin analysis. Other cities like Denver, Colorado, saw 58 percent of homes decrease in price in July. Construction of new homes has slowed as builders grow more worried about a drop in demand because of higher mortgage rates. Housing starts, or the start of construction on a new residential housing unit, fell to 1.45 million in July, according to Census Bureau data. That was a 9.6 percent decline from the month before. Builder confidence also fell in August for the eighth straight month as builders struggled to deal with lower demand for homes and higher construction costs because of ongoing supply-chain issues, according to a survey from the National Association of Home Builders. “The total volume of single-family starts will post a decline in 2022, the first such decrease since 2011,” Robert Dietz, the Association’s chief economist, said in a statement. After rising steadily earlier this year, new listings dropped to 670,766 in July, according to Redfin data. That’s down 132,649 new listings from the month before. The data indicates that potential sellers are staying put as home price growth slows down, said Daryl Fairweather, the chief economist at Redfin. The labor market is also strong and homeowners are sitting on record equity, Fairweather said, meaning that they aren’t feeling pressured to list their homes. “They were able to lock in really low mortgage rates, so they don’t really have a reason to sell,” Fairweather said. “If we entered into a recession and unemployment went up and homeowners couldn’t pay their mortgages anymore, then that would lead to a much faster decline in prices than what we’re seeing now. But I think it’s unlikely that will happen.” Even as new listings fall, the total inventory of homes for sale has climbed as supply improves. The number of active for-sale listings increased by 5.1 percent in July from the month before, marking the fifth consecutive month that inventory has increased, according to data from Zillow. Still, a more substantial increase in supply has been hindered by the lack of new listings and a slowdown in new construction. Rent prices also jumped during the pandemic, although the pace of growth has started to moderate. The typical monthly rent was $2,031 nationally in July, up 0.6 percent from June and 13.7 percent from a year ago, according to Zillow data. Rent typically rises over time and rarely sees any price declines, so rent will likely only become more expensive. And as more prospective homebuyers are priced out because of higher mortgage rates and pricier listings, that will likely keep demand high in the rental market, said Yelena Maleyev, an economist at KPMG. “What do people have to do if they can’t buy a house because so many more people are being priced out now with higher home prices and rising interest rates? They have to remain renters,” Maleyev said. Housing affordability across the nation has plummeted as mortgage rates have increased, according to the National Association of Realtors’ Housing Affordability Index, which measures whether an average family earns enough income to qualify for a mortgage loan on a typical home. Affordability fell in June as the monthly mortgage payment climbed 53.7 percent and the median family income rose 5.8 percent compared to a year ago. Although affordability is dropping and various metrics look concerning, a drastic downturn in the housing market is still unlikely, said Bachaud, the Zillow economist. Bachaud said the market is instead going through a “weird period of transition” to rebalance supply and demand after buyers struggled to find enough options earlier in the pandemic. “What’s happening in the housing market right now looks really scary compared to where we’ve been,” Bachaud said. “But it’s important to remember that this is all to rebalance to get us back into a normal market.” Support our midterm coverage this month Chaotic election cycles like this remind us how important an informed electorate is. Now is not the time for paywalls. Now is the time to point out what’s hidden in plain sight, clearly explain the answers to voters’ questions, illuminate the stakes of this election, and give people the tools they need to be active participants in America’s democracy. That’s what we try to do every day at Vox.We’re aiming to add 5,000 financial contributions from readers by the end of the month. This ensures that we can produce ambitious journalism, cover unexpected news moments, and continue to cover the latest updates on the removal of classified documents at Mar-a-Lago, at a scale that the news necessitates and keep it free — no matter what the advertising market is doing. You don’t have to pay for a subscription to access our work — even as inflation remains high. And we hope to keep it that way, even after the economy stabilizes. After mortgage rates hit record lows during the pandemic, driving up demand for new homes and pushing up listing prices, the housing market is now slowing down. That’s good news for buyers who can afford to stay in the market. But many prospective buyers are being priced out as high mortgage rates and steep prices make it unaffordable for some to purchase a new home. At the same time, new home construction has decreased as builders become warier of falling demand — and rent prices have continued to increase. What questions do you have about the US economy? Vox economic policy reporter Madeleine Ngo is here to help you unpack what’s happening with the economy and how it affects your life. Submit your question here. “Buyers have negotiating power really for the first time in several years,” said Nicole Bachaud, a senior economist at Zillow. “But that’s with the caveat of, only if you can afford home prices right now.” Here are seven charts that help explain what’s happening with the housing market. The average 30-year fixed mortgage rate reached 5.66 percent as of Sept. 1, according to Freddie Mac data. The rate has fluctuated in recent weeks, although it has slightly come down from its peak of 5.81 percent in June, which was the highest level since 2008. Mortgage rates cratered during the pandemic over fears about the coronavirus and its impact on the US economy (in January 2021, the 30-year fixed mortgage rate reached 2.65 percent). That led to increased demand for homes, since lower mortgage rates make the cost of purchasing a house much cheaper because people have to pay less interest each month. Mortgage rates rose rapidly earlier this year, in part because the Federal Reserve began raising interest rates to deal with high inflation. Although the Fed doesn’t directly set mortgage rates, higher interest rates generally make borrowing money more expensive across the economy. Fed policy is also one of the factors that can influence the 10-year Treasury yield, which fixed mortgage rates tend to track. As mortgage rates have risen, more buyers have been priced out of the housing market, cooling demand and increasing the supply of available homes. Sales of new single-family and existing homes have plummeted, signaling cooler demand as high mortgage rates and home prices push potential buyers out of the market. Sales of new single-family houses in July were at a seasonally adjusted annual rate of 511,000 units, which is down 12.6 percent from June, according to Census Bureau data. That marks a nearly seven-year low. The amount of time that listings are sitting on the market has also increased as competition has cooled down. The share of US homes that were listed for 30 days or longer without going under contract increased 12.5 percent in July compared to a year earlier, according to Redfin data. Prices of homes skyrocketed as more Americans tried to take advantage of lower mortgage rates earlier in the pandemic. The combination of lower mortgage rates and an already short supply of houses led to bidding wars among potential buyers who were making offers above the listing price to beat out their competitors. Although prices are starting to come down now, they still remain much higher than they were a year ago. The median existing-home price was $403,800 in July, according to data from the National Association of Realtors. That’s down $10,000 from June, but still 10.8 percent higher than a year before. Some regions have seen home prices drop more rapidly, particularly in towns that have seen stronger demand for homes during the pandemic. For example, 70 percent of homes for sale in Boise, Idaho, dropped in price in July, according to a Redfin analysis. Other cities like Denver, Colorado, saw 58 percent of homes decrease in price in July. Construction of new homes has slowed as builders grow more worried about a drop in demand because of higher mortgage rates. Housing starts, or the start of construction on a new residential housing unit, fell to 1.45 million in July, according to Census Bureau data. That was a 9.6 percent decline from the month before. Builder confidence also fell in August for the eighth straight month as builders struggled to deal with lower demand for homes and higher construction costs because of ongoing supply-chain issues, according to a survey from the National Association of Home Builders. “The total volume of single-family starts will post a decline in 2022, the first such decrease since 2011,” Robert Dietz, the Association’s chief economist, said in a statement. After rising steadily earlier this year, new listings dropped to 670,766 in July, according to Redfin data. That’s down 132,649 new listings from the month before. The data indicates that potential sellers are staying put as home price growth slows down, said Daryl Fairweather, the chief economist at Redfin. The labor market is also strong and homeowners are sitting on record equity, Fairweather said, meaning that they aren’t feeling pressured to list their homes. “They were able to lock in really low mortgage rates, so they don’t really have a reason to sell,” Fairweather said. “If we entered into a recession and unemployment went up and homeowners couldn’t pay their mortgages anymore, then that would lead to a much faster decline in prices than what we’re seeing now. But I think it’s unlikely that will happen.” Even as new listings fall, the total inventory of homes for sale has climbed as supply improves. The number of active for-sale listings increased by 5.1 percent in July from the month before, marking the fifth consecutive month that inventory has increased, according to data from Zillow. Still, a more substantial increase in supply has been hindered by the lack of new listings and a slowdown in new construction. Rent prices also jumped during the pandemic, although the pace of growth has started to moderate. The typical monthly rent was $2,031 nationally in July, up 0.6 percent from June and 13.7 percent from a year ago, according to Zillow data. Rent typically rises over time and rarely sees any price declines, so rent will likely only become more expensive. And as more prospective homebuyers are priced out because of higher mortgage rates and pricier listings, that will likely keep demand high in the rental market, said Yelena Maleyev, an economist at KPMG. “What do people have to do if they can’t buy a house because so many more people are being priced out now with higher home prices and rising interest rates? They have to remain renters,” Maleyev said. Housing affordability across the nation has plummeted as mortgage rates have increased, according to the National Association of Realtors’ Housing Affordability Index, which measures whether an average family earns enough income to qualify for a mortgage loan on a typical home. Affordability fell in June as the monthly mortgage payment climbed 53.7 percent and the median family income rose 5.8 percent compared to a year ago. Although affordability is dropping and various metrics look concerning, a drastic downturn in the housing market is still unlikely, said Bachaud, the Zillow economist. Bachaud said the market is instead going through a “weird period of transition” to rebalance supply and demand after buyers struggled to find enough options earlier in the pandemic. “What’s happening in the housing market right now looks really scary compared to where we’ve been,” Bachaud said. “But it’s important to remember that this is all to rebalance to get us back into a normal market.” Support our midterm coverage this month Chaotic election cycles like this remind us how important an informed electorate is. Now is not the time for paywalls. Now is the time to point out what’s hidden in plain sight, clearly explain the answers to voters’ questions, illuminate the stakes of this election, and give people the tools they need to be active participants in America’s democracy. That’s what we try to do every day at Vox.We’re aiming to add 5,000 financial contributions from readers by the end of the month. This ensures that we can produce ambitious journalism, cover unexpected news moments, and continue to cover the latest updates on the removal of classified documents at Mar-a-Lago, at a scale that the news necessitates and keep it free — no matter what the advertising market is doing. You don’t have to pay for a subscription to access our work — even as inflation remains high. And we hope to keep it that way, even after the economy stabilizes. Article Sourced from Vox.

More Pending Homes Are Falling Through, but No Need to Sound the Alarms

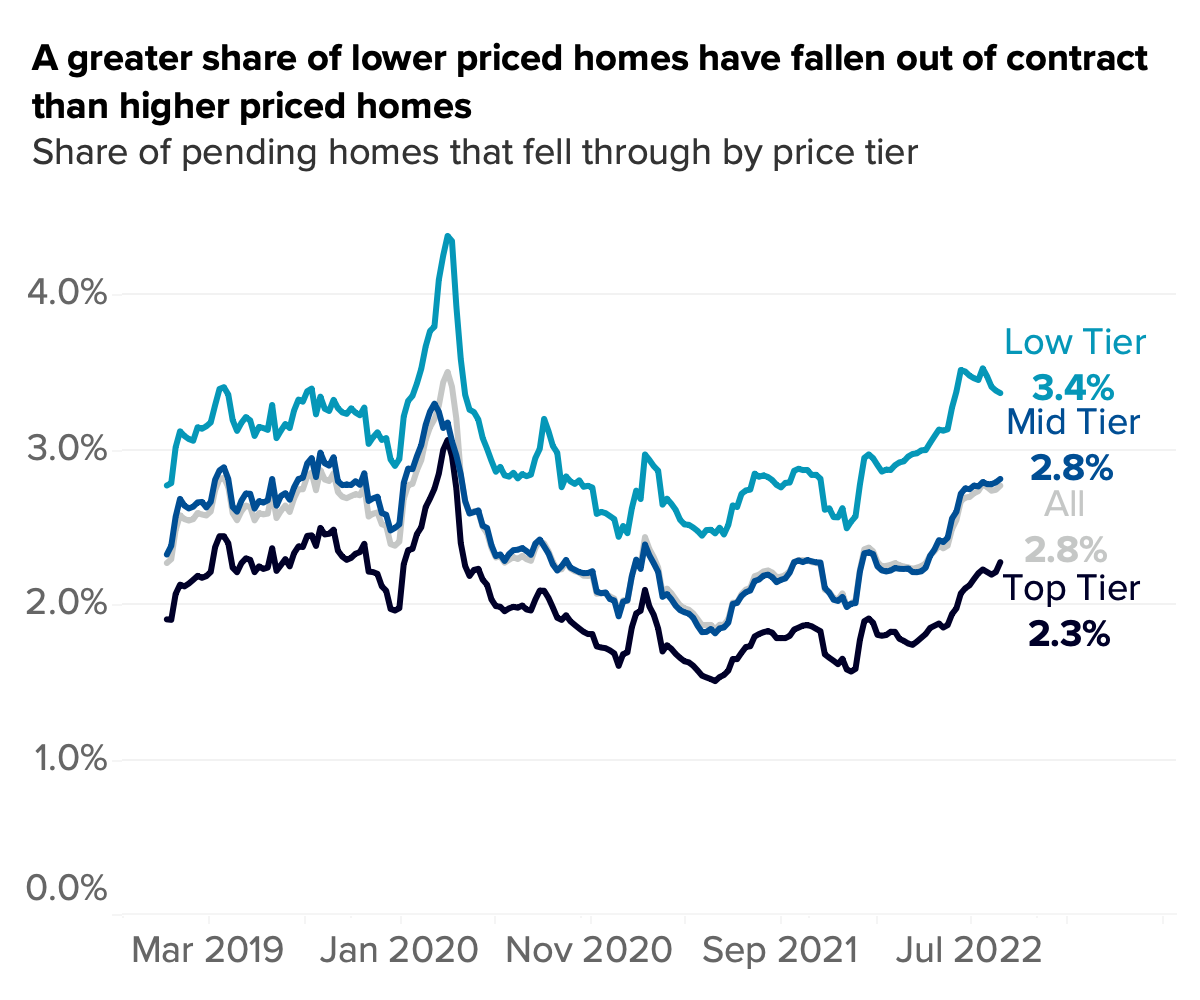

By Nicole Bachaud on Sep. 8, 2022 The share of contract cancellations — pending listings that have gone back on the market without a sale — has recently increased, but remains in line with pre-pandemic norms. The recent increase in contract cancellations is more evidence of a rebalancing in the housing market that has both eased buyer demand and given buyers who remain in the market more negotiating power than they have had for most of the pandemic. A greater share of lower priced homes have fallen out of contract than higher priced homes. This likely reflects affordability challenges taking their toll on buyers with relatively lower incomes as mortgage rates have risen. A quickly rebalancing housing market – brought about by sharp increases in mortgage rates that have pushed monthly payments beyond what many can afford – has caused homebuyers and sellers to reset their expectations. One outcome of these rapidly changing conditions and shifting expectations is a recent increase in the share of pending home sales that fall through. As of the end of August, the share of pending home sales that fell through, then ended up back on market – measured weekly – had increased by 0.8 percentage points (2.0% to 2.8%) from the beginning of the year. Put differently, about one of every 36 pending sales fell through in the last week in August, compared to about one in every 50 at the beginning of the year, and one out of every 45 at the end of last August. There are a number of reasons why a pending home sale would fall through. Quickly rising mortgage rates were likely causing some buyers to move from being able to afford a mortgage on the home they bid on, to not being able to afford that mortgage as the cost exceeds their allowable limit for a debt to income ratio. Affordability is likely a major reason why contracts fail, especially as more lower priced pending homes end up back on market than other price tiers. Another cause of contract cancellations could be from buyers taking back control of negotiating power. Competition for homes has eased as many buyers have taken a step back from the market. Inspections and other contingencies are no longer being waived to the same degree as earlier in the pandemic. A failed inspection or any questionable findings might be leading to more contracts falling through now while desperate buyers may have been more willing to go through with a risky purchase when competition was at a fever pitch earlier in the pandemic. Regardless of why a deal failed to close, the recent increase in this dynamic is yet more evidence of how the housing market has quickly shifted in recent months. And more evidence that perhaps well-off buyers are really able to be more choosy in this market now that competition is less of a concern, and are less keen to jump on a home simply because it’s available. The 80-basis-point increase in the share of pending sales that fall through is a significant shift, but the share of pending sales that don’t result in a sale remains within pre-pandemic norms. In the years preceding the COVID-19 pandemic, the weekly rate at which pending sales fell through was generally around 2.5%, in line with what the market is seeing now. What’s more, the share of pending fall throughs has recently shown signs of stabilizing. This may be due to buyers exiting the market altogether as affordability challenges persist, or reflect that pricing and sales expectations have adjusted to meet the changing market conditions. Throughout the Sun Belt, which hosts the majority of the hottest markets of the pandemic where prices rose the fastest, the cooldown will feel more intense as there is more room to fall back to normal from the high peaks of home value appreciation. Salt Lake City and Dallas, both relatively competitive markets during the past few years, saw the share of pending homes that fell through increase by more than two percentage points since the beginning of 2022, more than doubling the share of cancellations in these markets as interest rates rose and the market began to shift. Sellers are needing to reset their expectations as buyers are either stepping back from the market because of affordability constraints, or holding more negotiating power and requiring more realistic prices and terms if they’re still able to afford to buy. Zillow Group is committed to ensuring digital accessibility for individuals with disabilities. We are continuously working to improve the accessibility of our web experience for everyone, and we welcome feedback and accommodation requests. If you wish to report an issue or seek an accommodation, please let us know. Zillow, Inc. holds real estate brokerage licenses in multiple states. Zillow (Canada), Inc. holds real estate brokerage licenses in multiple provinces.§ 442-H New York Standard Operating Procedures§ New York Fair Housing NoticeTREC: Information about brokerage services, Consumer protection noticeCalifornia DRE #1522444

San Diego rent can increase up to 10% after CA law

SAN DIEGO — Rent could increase up to 10 percent at tenant’s next renewal because of a California law. A law passed in 2019 kicked back into effect on Aug. 1, because the federal eviction moratorium expired July 31. The California Tenant Protection Act of 2019, or AB1482, limits annual rent increases to no more than 5%, plus the local Consumer Price Index (the inflation rate), or 10%, whichever is lower. Since inflation is so high, a 10% rent increase is lower than 5%, plus the local inflation rate. According to the Bureau of Labor Statistics, the CPI for San Diego is more than 8%. Since the law states that the maximum increase is either 10%, or 5%, plus CPI (in this case it would be about 8% + 5% =13% rate increase), 10% is the lower percentage and currently the cap. San Diego saw “over the last 12 months, the CPI-U rose 8.3%. Food prices jumped 12.5%. Energy prices rose 34.0%.” “It’s actually a good thing that there is now a maximum on how high it can really go,” Mylene Merlo, a local independent real estate broker said. Newsom declares Monkeypox State of Emergency “Groceries were already going up, gas was already going up, inflation and everything we were already feeling the pain already and now with this, it’s just the cherry on top,” said Amber Brewer, who is one of thousands of renters now facing a rent hike. Her Carlsbad rent increased $240 a month, which is just shy of the 10% maximum now allowed in California. TOP STORIES Photos: Galactic bar crash-lands in San Diego Photos of man suspected of assaulting teen released Photos of man suspected of assaulting teen released “What am I going to do, I’m going to have cut costs somewhere, I’m going to totally have to scale back,” Brewer said. “I’m a single mother and I’m taking care of my mom who is disabled and so I’ve got to cut costs.” During the pandemic, many landlords took a financial blow because they lost out on some rent and are now trying to make up for it, Merlo said. One California county deemed ‘most vulnerable’ to extreme heat on federal map According to the United States Census Bureau, 1.4 million Californians are behind on rent payments. “San Diego has no rent control, which means that generally landlords have been able to charge however much they want,” Merlo said. The state law protects many renters from seeing a more than 10% rent increase, but it doesn’t protect everyone. AB 1482, or “the California Tenant Protection Act of 2019,” went into effect on Jan. 1, 2020 and will expire on Jan. 1, 2030. There are exemptions to this, including: Units built within the last 15 years. This applies to whichever year it is currently. In 2022, this act would not apply to housing units built after 2007. Low-income housing; Certain dorms; A two-unit property, such as a duplex, where the owner lives in one portion and rents out the other; Single-family homes and condos are not covered if they are owned by a real estate trust, corporation or LLC. Full article here Fox 5 San Diego Zara Barker August 2, 2022

Categories

Recent Posts